First Abu Dhabi Bank (FAB), renowned for its innovative banking solutions, offers a seamless online experience for customers to check their balances effortlessly. With FAB Bank balance check online, clients can monitor their accounts, review transactions, and manage finances with a user-friendly interface. This digital approach reflects the bank’s commitment to modern and accessible banking services. This empowers customers to stay in control of their financial well-being at their fingertips.

FAB bank balance check can be done online or in person. There are a few methods through which you can do so conveniently. FAB Bank Online Balance Check can be done using the official FAB bank website and app on mobile devices. You can visit a nearby ATM if you want to check the balance in person. We will explain all three methods step-by-step here, so you won’t get confused about how to check your current bank balance.

Advertisements

FAB Balance Check: 4 Easy & Quick Online Methods in 2024

Furthermore, we will also discuss how to do a FAB Bank Salary Account Balance Check. You should read this article completely to understand how to check the balance of your accounts.

How to Check the FAB Bank Balance

The FAB balance enquiry online can be done from anywhere. The process is straightforward and in just a few clicks, you can get to know about your current balance and last ten transactions. There are three ways through which you can do a FAB Bank Balance Check Online. These include visiting the website, using the FAB mobile app, or balance check through the ATM.

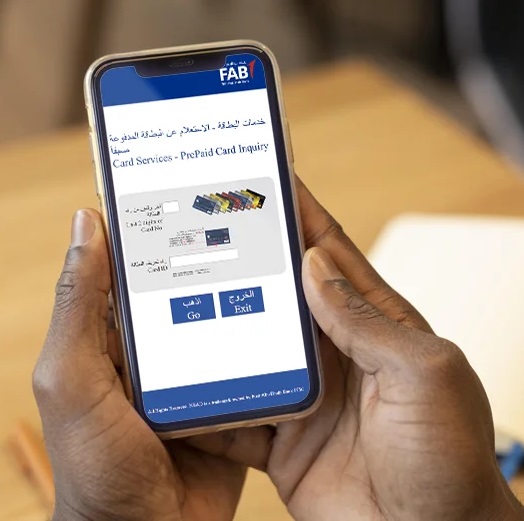

The following is the method for your FAB prepaid card inquiry through the bank’s official website. This is the most convenient and hassle-free method that can also be done in the comfort of your home. You just need a mobile or laptop device and an internet connection in order to proceed.

FAB Bank Balance Check through the FAB Website

Step 01: Visit the official website of FAB Bank: https://ppc.bankfab.com/PPCInquiry/.

Step 02: After that, you will see two boxes where you have to enter your information regarding your prepaid, credit, or debit card. You must have that in hand before doing the FAB balance enquiry.

Step 03: Now enter the last two digits of your card on the website’s interface where it is required. Once you are done with it, fill in the second column with your 16-digit Card ID number.

Step 04: Click on “Go” and you will be able to see the last ten transactions on your card. Here you can also get information about your transactions date-wise.

FAB Bank Balance Check through the FAB Mobile App

You can also perform a FAB Balance Enquiry Online through the official mobile application. The app is available to both iOS and Android users. You can download and install it and avail banking services online. Following is a detailed procedure through which you can do a FAB bank check balance using the mobile app:

Step 01: Download and Install the official FAB App available on Apple and Google playstores.

Step 02: Once you have downloaded the app, log in to it using your account credentials.

Note: If you are using the app for the first time, you will have to create an account first. To do so, you need to enter your debit card and customer ID number. The system will send a 6-digit PIN to your mobile number or email address. It will be used to log into your account in order to access it.

Step 03:Upon logging in, you can view your account balance.

Step 04: You will also be able to see your last 10 transaction details on the app.

FAB Bank Balance Check through the ATM Machines

Checking balances using this method is one of the most traditional methods. FAB Balance Enquiry can also be done through an ATM. All you have to do is take your bank card (credit or debit) to your nearest branch and follow the steps mentioned below.

Step 01: Visit the ATM with your bank card and insert it into the machine.

Step 02: The system will display various options including cash withdrawal, deposit, etc. Tap on the ‘Check Balance‘ option on the screen.

Step 03: The system will ask for your PIN. Enter it and it will display your current balance.

Also check out: Lulu Balance Check | Lulu Exchange Salary Card Balance Check

How to open a FAB bank account?

There are several options available when opening a FAB Bank account. These include current, savings, and salary accounts.

If you want to open a FAB Bank account, there are four options:

- Call FAB Bank customer service and complete the application process over the phone.

- Visit your nearest FAB Bank branch with the required documents and fill out the necessary forms.

- Download the bank’s mobile app. Complete the application form, upload the required documents, and submit it online.

- Open the bank’s official website and fill out the application form.

Additionally, you must verify your mobile number and provide proof of your identity and address. Once your account is created, the bank will issue you a debit card. You can use this card to withdraw cash, transfer money online, make purchases in stores, or do online shopping.

How To Activate FAB Mobile Banking?

To activate FAB mobile banking, you must have the bank’s debit card. If you have one, follow the instructions below.

Step 01: Download and install the FAB Bank mobile app on your mobile device.

Step 02: Open the application and sign up for mobile banking.

Step 03: Enter your debit card information and the OTP number sent to your registered mobile phone or email address.

Step 04: Follow the on-screen instructions to create a new password for your login.

Once the account is created on the mobile app, you can use it to pay bills, check balance, and transfer money.

FAB Bank Salary Account Balance Check

Do you have a FAB bank salary account and want to make an enquiry online? Don’t worry, the procedure is the same as above.

The FAB bank offers accounts for individuals who receive monthly salaries. This is just a convenience for these users who want their finances checked. Otherwise, the process for FAB balance check enquiry is the same as it is for other account types.

You can do so through any of the methods discussed above. But the most convenient way is to check your balance on the official FAB website.

For this purpose, FAB Bank also offers a prepaid card to its salary customers. Users can use it to withdraw cash and transfer money to other bank accounts. You can also use this card to shop online, pay for services, and make purchases at different stores.

FAB Prepaid Card Benefits

The First Abu Dhabi Bank salary check is one of the most convenient methods for salaried or daily wage earners. The FAB bank balance enquiry can be done easily on its official website or via the mobile app online. Apart from this, the bank also provides other benefits to its employees and employers and so has become one of the most favorite banks in Abu Dhabi. Following is the list of benefits it provides to employees and employers:

Advertisements

Benefits for Employees:

- A user-friendly online portal

- Customer service is available 24/7

- Free accident insurance

- SMS alerts

- It can be used worldwide

- No bank account required

- A minimum balance is not required

- Multiple ATMs

- WPS safety

Benefits for Employers:

- Secure online transfers

- Online card services are available

- Automated payroll management

- Payment of salaries using net-banking

Cashback Offers for Salaried Individuals from FAB:

A FAB Ratibi card offers cashback to salaried individuals from the bank on each salary transferred. To do so, you must have access to the mobile application of the bank.

If you are a UAE national, you can get cash back of up to AED 5000 for salary transfers, and in the case of a foreign worker, an amount of up to AED 2500 is brought back into the account as cash back for salary transfers.

The cashback can be used to pay utilities, groceries, fuel, or for any other payment. So, don’t wait and have your salaries transferred to your FAB Bank.

Cashback Offers for Expats from FAB:

Apart from being a resident, the Ratibi FAB also offers cashback to its ex-pats. These citizens can enjoy special deals and offers outside of the UAE. Following is a table that shows the amount of cashback that the FAB offers to its ex-pats:

| Earnings Range | UAE National Cashback | Expatriate Cashback |

|---|---|---|

| AED 0 – 2,999 | 0 | 0 |

| AED 3,000 – 4,999 | Up to AED 1,000 | Up to AED 500 |

| AED 5,000 – 14,999 | Up to AED 2,500 | Up to AED 1,500 |

| AED 15,000+ | Up to AED 5,000 | Up to AED 2,500 |

The above-mentioned were the reasons why the First Abu Dhabi Bank is one of the most liked banks in all of the UAE. Apart from its easy FAB balance enquiry online, the bank also offers special facilities to its customers. To do so, one must have in possession the FAB Bank card and registration on the mobile app.

FAQs

How to check FAB bank balance?

To do a FAB bank check balance, you can visit the official website, mobile app, or through an ATM. All of these methods are very convenient and straightforward. You can do so from the comfort of your home by simply having an electronic device and an internet connection.

How to cancel a FAB bank account?

You can cancel your FAB bank account online on their website. However, it is recommended that you contact the customer service center or visit a local bank branch. The bank may require you to fill out an account closure form or submit a written request.

What is the minimum balance at FAB Bank?

There’s no such criteria to maintain a minimum balance in a FAB Bank account. However, if you have a savings account, you will need to maintain a minimum of AED 3,000. If you are unable to maintain this minimum balance criteria, you will be charged with a penalty of AED 10 per month. However, if you are using your account just for withdrawals and deposits, you do not need to worry about this criteria. As in that case, your account is an Elite savings account by default and hence you are not liable to maintain this balance.

How to check FAB bank salary account Balance?

You can do your FAB balance inquiry on your smartphone after downloading and installing the FAB App. This application is available to both Android and iOS users. Once you have downloaded it, log in with your username and password and you will be able to see your account balance on the homepage.

Advertisements

Everything About Emirates – TheEmiratesInfo

Everything About Emirates – TheEmiratesInfo